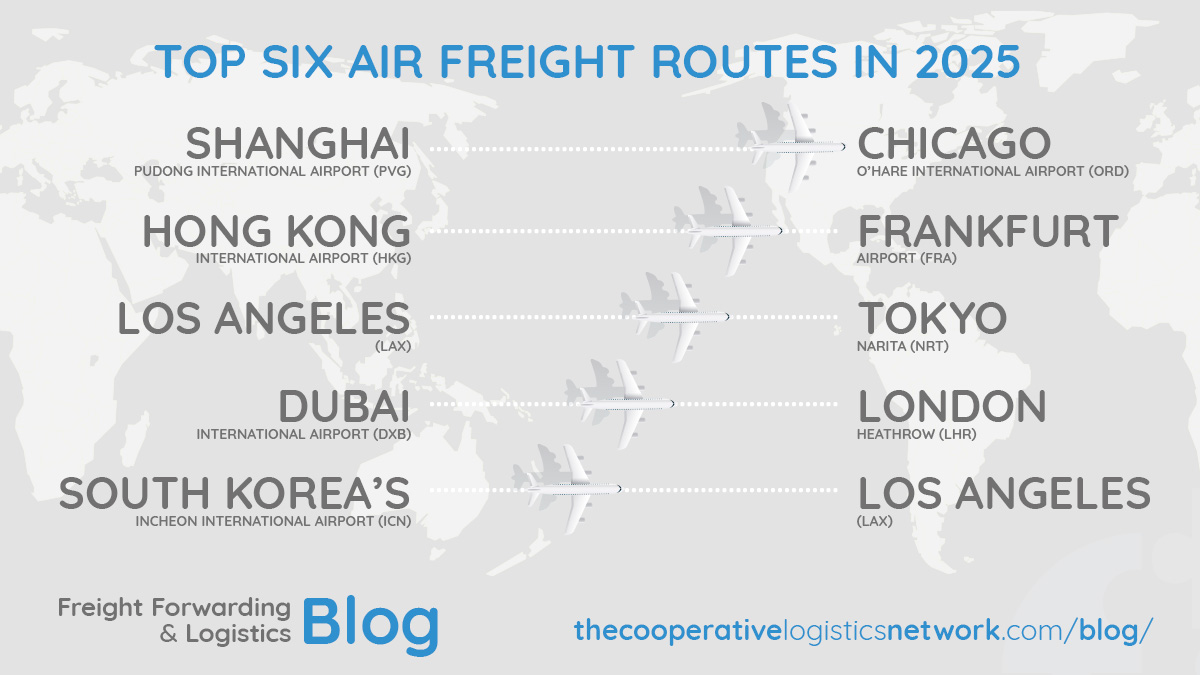

As global trade continues to recover and evolve in 2025, air freight companies are seeing record-breaking volumes on several key international trade routes. The growth of e-commerce, the urgency of time-sensitive shipments, and the return of high-value manufacturing in certain regions have made air cargo a vital component of supply chain strategies. From Asia-Pacific to North America, these routes aren’t just moving goods—they’re shaping global logistics trends. Understanding where demand is surging can help air freight companies align capacity, invest in infrastructure, and develop new partnerships. Let’s take a closer look at the top six air freight routes in 2025, which are driving the highest levels of demand and offering the most opportunity for logistics players.

1. Shanghai – Chicago: The Manufacturing-Ecommerce Power Corridor

The trade corridor between Shanghai Pudong International Airport (PVG) and Chicago O’Hare International Airport (ORD) remains one of the most heavily trafficked and economically significant air freight routes in the world. In 2025, this route is fueled by a combination of Chinese manufacturing exports—particularly electronics, apparel, and machinery—and America’s ever-growing appetite for online retail.

Chicago serves as a vital inland port for the U.S., with strong road and rail connections to the entire Midwest. This makes it an attractive hub for goods coming in from East Asia. Simultaneously, Shanghai continues to dominate as China’s export powerhouse, bolstered by smart logistics zones and bonded warehouse facilities.

Air freight companies operating on this route are adapting by increasing their cargo capacity, adopting digitized customs processes, and collaborating with freight forwarders to meet tight delivery windows. The high volume and consistency of this route make it a top priority for investment in technology and fleet efficiency.

2. Hong Kong – Frankfurt: Bridging Asia and Europe

The air route from Hong Kong International Airport (HKG) to Frankfurt Airport (FRA) plays a pivotal role in connecting Asia’s high-tech manufacturing centers with Europe’s consumer and industrial markets. Frankfurt, Europe’s busiest cargo airport, is the entry point for much of the EU’s airfreight. Meanwhile, Hong Kong continues to be a logistics giant despite regional competition, thanks to its free port status and customs-friendly environment.

In 2025, there is a renewed emphasis on electronics, automotive components, and luxury goods. As supply chains strive for resilience, many European companies are diversifying sourcing beyond mainland China while still using Hong Kong as the shipment point due to its world-class cargo handling systems.

For air freight companies, this route demands precision, capacity planning, and close coordination with ground handling partners. The increasing integration of real-time visibility tools and AI-driven cargo management systems is streamlining operations along this corridor.

3. Los Angeles – Tokyo Narita: A Strategic Gateway for Air Freight Companies

The Los Angeles (LAX) to Tokyo Narita (NRT) corridor continues to gain prominence in 2025, driven by a dynamic mix of high-tech exports, automotive parts, and e-commerce traffic. Japan’s advanced manufacturing sector and strong trade ties with the U.S. make this route strategically essential.

Tokyo Narita is known for its efficiency in processing cargo and connecting to other Asian countries via short-haul flights. Meanwhile, LAX remains a core logistics hub on the U.S. West Coast with facilities that are increasingly optimized for cross-border e-commerce.

Air freight companies find this route highly lucrative due to the consistent volume, premium pricing for time-sensitive cargo, and the growing demand for temperature-controlled shipments like pharmaceuticals. Additionally, this corridor is witnessing a rise in reverse logistics as Japanese companies expand after-sales service and return logistics to North America.

4. Dubai – London Heathrow: A Luxury and Pharma Corridor

In 2025, the air freight route from Dubai International Airport (DXB) to London Heathrow (LHR) is seeing remarkable growth, especially in luxury goods, pharmaceuticals, and high-value electronics. Dubai, known for its world-class logistics infrastructure and Free Trade Zones, serves as a major re-export hub for goods originating from Asia and Africa.

London Heathrow, while historically passenger-heavy, is fast adapting to the increasing importance of cargo. With the U.K. pursuing new global trade partnerships post-Brexit, the demand for speedy, secure, and reliable air freight has surged.

This route benefits air freight companies looking to serve both developed and emerging markets through a central corridor. Emirates SkyCargo and other carriers have doubled down on digital freight booking platforms, improved cargo tracking, and advanced cold chain logistics to accommodate the demand on this lane.

5. Incheon – Los Angeles: E-commerce Goldmine for Air Freight Companies

South Korea’s Incheon International Airport (ICN) to Los Angeles (LAX) is another key air freight route that has surged in demand thanks to Korea’s booming electronics and beauty products sectors, along with a sharp increase in cross-border e-commerce shipments.

In 2025, Korean e-commerce giants like Coupang and global players like Amazon and eBay are relying heavily on this corridor to meet demand from U.S. consumers. With fast fulfillment as a competitive edge, speed has become paramount.

Air freight companies operating on this route are investing in high-speed sorting centers, air-to-ground data integration, and end-to-end tracking services. Incheon’s role as a global cargo hub continues to strengthen with the expansion of its logistics park and increased air cargo terminal automation.

6. Singapore – Sydney: Southeast Asia to Oceania Trade Booster

As Southeast Asia deepens its economic ties with Australia, the Singapore Changi Airport (SIN) to Sydney Kingsford Smith Airport (SYD) route has emerged as a vital air freight link. Singapore is the region’s most advanced logistics and financial hub, while Australia is increasing imports of electronics, apparel, and food products from ASEAN countries.

This route has grown in importance particularly due to demand from Australian SMEs and e-commerce retailers sourcing products from Southeast Asia. On the reverse leg, Australia’s agricultural and food exports to Southeast Asia are also experiencing a boost.

Air freight companies servicing this route are focusing on improving customs clearance speed, investing in digital trade documentation, and deploying flexible cargo solutions to manage uneven volumes. Changi’s air cargo community and smart airport systems offer a competitive edge to forwarders and carriers alike.

Final Thoughts: Seizing the Opportunity in a Competitive Market

In 2025, these six routes represent the beating heart of global air cargo. As demand surges for speed, reliability, and visibility, the expectations from air freight companies have never been higher. Whether transporting high-tech electronics, temperature-sensitive pharmaceuticals, or fast-fashion apparel, carriers and forwarders must adapt rapidly to the complexities of modern trade.

These corridors not only link global markets—they also shape the future of air freight. Staying competitive means investing in technology, building resilient partnerships, and maintaining operational excellence.

One of the smartest moves for companies operating on these high-demand routes is to collaborate through global logistics networks. Joining a trusted and professional alliance like The Cooperative Logistics Network allows air freight companies to expand their global reach, tap into a community of vetted partners, and access exclusive tools and resources. In an industry where timing and trust are everything, being part of a reliable logistics network can make the difference between missed opportunities and sustained growth.

As 2025 progresses, the sky is the limit for those ready to evolve—and to fly where the demand is greatest.