The Belt and Road Initiative (BRI), launched by China in 2013, has become one of the most ambitious infrastructure and connectivity programs in modern history. It spans over 140 countries, with investments in roads, railways, ports, and economic zones aimed at boosting global trade. While it’s often framed in geopolitical terms, the real story, especially for logistics professionals, is the transformation of supply chains and the emergence of powerful logistics hubs along its corridors. For freight forwarders, these hubs present major opportunities: new markets, new trade flows, and a fresh push toward multi-modal transport. The challenge? Understanding where the growth is happening and how to plug in.

Southeast Asia: The maritime gateway

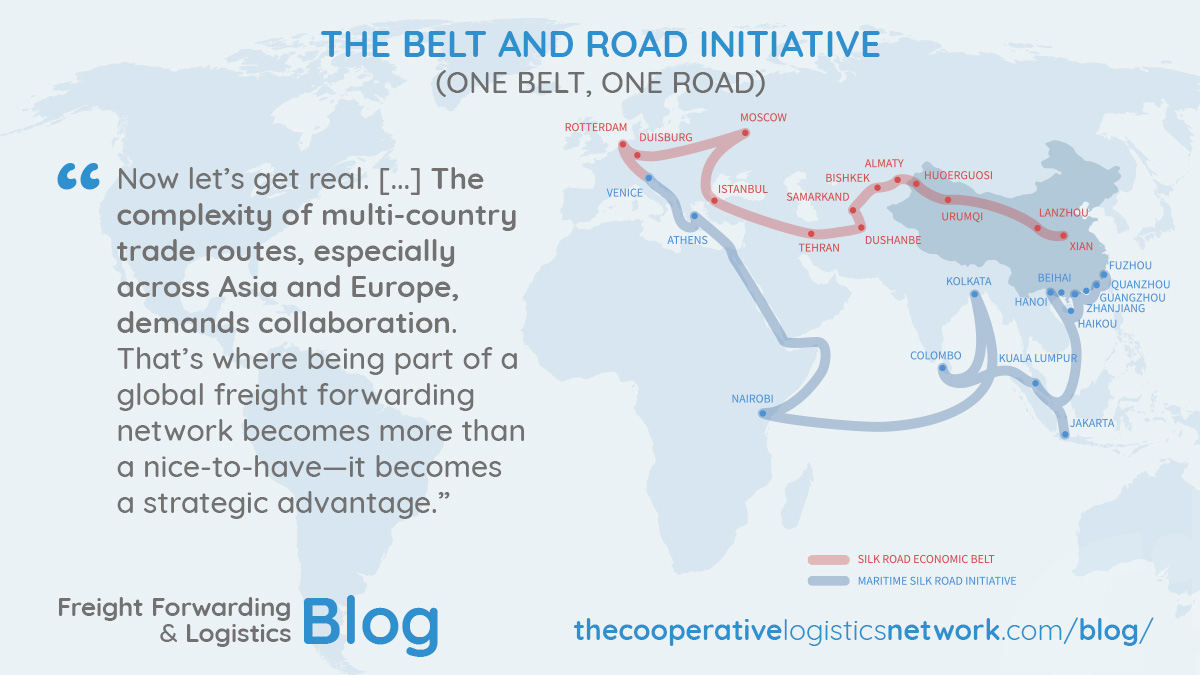

The Maritime Silk Road, the sea-based leg of the Belt and Road Initiative, cuts through Southeast Asia before heading west toward Africa and Europe. This region has seen massive upgrades in port capacity, customs infrastructure, and multimodal connectivity.

Singapore, already one of the world’s most efficient ports, is expanding its Tuas Mega Port to consolidate operations and support growing transshipment volumes. Malaysia’s Port Klang and Tanjung Pelepas, meanwhile, are positioning themselves as key nodes for Chinese exports headed to South Asia and Africa.

Further north, Vietnam’s Hai Phong and Da Nang are seeing increased Chinese investment. With Vietnam emerging as a favored nearshoring destination, its ports are booming with activity. For freight forwarders, Southeast Asia is no longer just a pass-through region, it’s a hub in its own right. Regional distribution, last-mile delivery, and warehousing are all areas of growth.

Central Asia: The overland bridge

One of the most transformative impacts of the Belt and Road Initiative has been in Central Asia, a region historically landlocked and isolated from global trade lanes. Today, it’s become a vital overland bridge between China and Europe.

Kazakhstan’s Khorgos Gateway is a standout example. Built on the China-Kazakhstan border, Khorgos is a dry port that facilitates seamless rail freight movement. It’s part of a larger push to make rail a viable alternative to sea shipping between Asia and Europe.

Uzbekistan and Turkmenistan have also been upgrading their road and rail systems, aiming to integrate into the New Eurasian Land Bridge. While these countries are still maturing as logistics markets, early movers in freight forwarding can gain a foothold and build long-term presence as the infrastructure matures.

Eastern Europe: Endpoints with momentum

The western arm of the Belt and Road Initiative lands in Eastern Europe, where cities like Łódź in Poland, Duisburg in Germany, and Budapest in Hungary are becoming hotbeds for logistics.

Duisburg, the world’s largest inland port, is now a central hub for trains arriving from China. Its direct rail connections make it an anchor point for distributing goods across Europe. Freight forwarders operating in and around Duisburg benefit from high-speed customs clearance, warehousing zones, and a dense trucking network to the rest of the continent.

Poland, meanwhile, has leveraged its geographic position to become a preferred rail freight destination. The China-Poland rail route is one of the most active, with regular service and growing volumes. Hungary, through joint projects with Chinese logistics firms, is rising as a cross-border hub for goods heading to Southern and Eastern Europe.

Middle East and Africa: The emerging connectors

Although not traditionally considered logistics powerhouses, several countries in the Middle East and Africa are quietly becoming crucial to the Belt and Road Initiative. Oman’s Port of Duqm and the UAE’s Jebel Ali Port are part of China’s broader maritime strategy to control chokepoints and improve access to African markets. In Africa, Kenya’s Mombasa Port and Djibouti’s deepwater port are part of a network supporting China-Africa trade. These locations are seeing investments not just in port capacity but also in rail networks, customs modernization, and digital tracking systems.

As Africa’s consumer market grows, freight forwarders with early exposure in these regions will be well-positioned to capitalize on intra-continental trade growth and increasing export volumes.

Where freight forwarders fit in

Now let’s get real. It’s one thing to identify where infrastructure is expanding; it’s another to build a logistics business around it. For freight forwarders, the biggest opportunity the Belt and Road Initiative offers is the chance to diversify service offerings, expand geographic reach, and participate in growing trade corridors. But this isn’t a solo game. The complexity of multi-country trade routes, especially across Asia and Europe, demands collaboration. That’s where being part of a global freight forwarding network becomes more than a nice-to-have—it becomes a strategic advantage.

Why joining The Cooperative Logistics Network helps

For freight forwarders in any of these emerging BRI hubs, whether in Tashkent, Hanoi, Lodz, or Mombasa, joining an international network like The Cooperative Logistics Network (The Coop) offers immediate benefits. Members get access to a vetted pool of over 370 reliable logistics partners in over 130 countries. This can be the difference between handling a shipment confidently across borders and scrambling to find a trustworthy partner on the ground.

Through The Coop, freight forwarders gain visibility, access shared tools for shipment management, and even benefit from protection mechanisms like the Payment Protection Programme. It’s a simple way to scale operations globally while keeping control locally. And in the Belt and Road context, where agility and reliability go hand in hand, this edge is critical.

Digital infrastructure: The invisible backbone

One area that often gets overlooked in BRI discussions is the digital side of logistics. China’s Digital Silk Road is investing in e-commerce infrastructure, smart customs, blockchain-based clearance systems, and satellite positioning technologies across participating countries. For example, blockchain pilot programs in Georgia and Pakistan are speeding up customs clearance and reducing fraud. These systems will eventually become standard across many BRI countries, and freight forwarders need to stay ahead of the curve. Forwarders who invest in tech, not just tracking but integration with clients, customs, and partners, will stand out. Networks like The Coop that encourage digital adoption help members stay competitive in a changing market.

The takeaway

The Belt and Road Initiative is reshaping global trade routes, and logistics hubs across Asia, Europe, and Africa are evolving rapidly. For freight forwarders, this isn’t just about watching from the sidelines. It’s a chance to move in, build partnerships, and be part of the infrastructure that’s redefining global commerce.

From the dry ports of Central Asia to the inland terminals of Europe, and from the maritime gateways of Southeast Asia to the deepwater ports of Africa, opportunities abound. But to tap into them, freight forwarders need both global reach and local insight. They need partners they can trust.

That’s why understanding the Belt and Road Initiative is step one and building a network of reliable collaborators is step two. The ones who act now will be the ones who shape trade in the decades ahead.