The congestion in European ports in 2025 has reached a critical level, disrupting trade routes across the continent and creating ripple effects far beyond the region. Major ports in Northern Europe such as Bremerhaven, Antwerp, Hamburg, and Rotterdam, are experiencing severe delays, with average berth waiting times increasing between 37% and 77% in just a few weeks. This situation is not just a logistical challenge; it’s a strategic wake-up call for freight forwarders, shippers, and carriers worldwide.

The congestion crisis in Northern Europe

Delays of 48–72 hours in ports like Rotterdam, Antwerp, and Hamburg have become the new normal as of June 2025. These ports, already among the busiest in Europe, are now buckling under the pressure of increased demand for containers during the summer peak. What’s making the problem worse is the sheer number of ports involved. Ships are arriving at multiple congested hubs, stretching the limits of even the most modern port infrastructure. Rotterdam, often the first stop in many shipping loops, has lost its advantage due to strikes, technical restrictions, and an overwhelming cargo volume.

Antwerp has seen a 37% increase in waiting times, rising from 32 to 44 hours between April and May. Hamburg’s delays climbed 49%, while Bremerhaven’s waiting times surged by 77%. These delays are driven by labor shortages, staff strikes, and low water levels on the Rhine River that have limited barge movement to inland regions.

Ripple effects- Congestion in European ports is a global issue

The impact of congestion in European ports isn’t contained to Europe. Analysts suggest that shipping congestion is spreading to ports in the US and Asia. Shenzhen, Los Angeles, and New York have all reported a growing backlog of container vessels waiting to berth. Part of the problem stems from shifting US tariff policies that temporarily rolled back duties on Chinese imports, sparking a rush of shipments and straining port capacities. Freight forwarders now face inventory planning chaos, as delays in Europe throw off supply chain timelines globally.

Red Sea disruptions and alliance restructuring

The Red Sea situation remains unstable, forcing many carriers to take the longer route around Africa. To make matters worse, large shipping alliances have begun skipping some of the most congested ports. For instance, Maersk has restructured routes to exclude Rotterdam, instead extending service to Nordic terminals via Hamburg. Other lines like MSC and CMA CGM are also adjusting their networks, either by expanding into Eastern Europe or diverting vessels to less-congested Mediterranean hubs such as Genoa or Barcelona. But even these alternatives have limitations, including reduced capacity and limited intermodal connectivity.

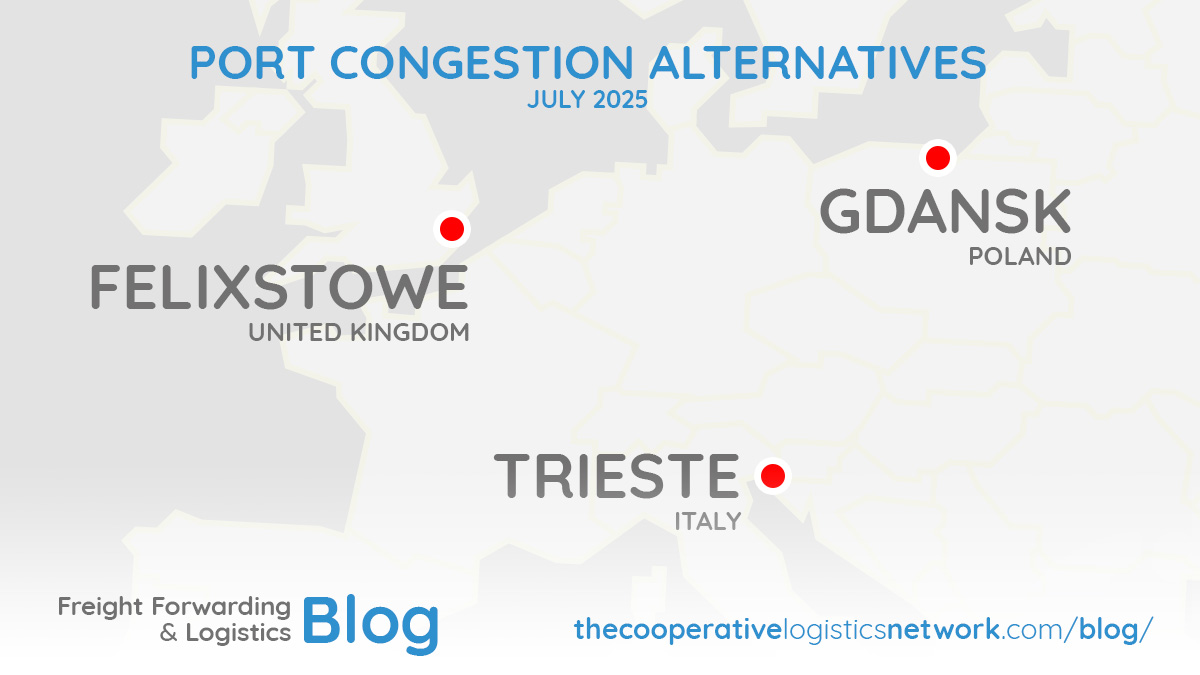

Port congestion alternatives

Freight forwarders are now looking beyond the usual hubs. Here are the top alternatives to Rotterdam and Antwerp that are currently seeing more traffic but maintaining better throughput:

- Felixstowe, UK: 10–30 hour delays, lower congestion

- Gdansk, Poland: Efficient for Eastern European and Baltic routes

- Trieste, Italy: Excellent for multimodal cargo to Central Europe

Keep in mind: smaller ports come with their own risks, including less infrastructure and naturally longer processing times—delays of 10–40 hours are considered normal for these locations.

Inland transport disruptions

The historically low water levels on the Rhine have had a significant impact on inland barge transport. Limited capacity has reduced the volume of goods moving by barge, increasing demand for rail and road transport.

Freight forwarders should:

- Shift high-priority shipments to rail or truck

- Increase cargo volumes per voyage to offset rising costs

- Plan barge shipments earlier, avoiding sudden restrictions from dropping water levels

Tips for managing port congestion in Europe

To keep supply chains moving, freight forwarders need to act proactively. Here are a few strategies:

- Advanced freight booking: Secure capacity early and lock in rates before further disruptions

- Real-time shipment tracking: Use tools like SeaRates Container Tracking for predictive ETA and exception alerts

- Schedule control: Monitor vessel schedules at smaller ports with faster handling times

- Cost comparison: Evaluate rerouting options with logistics platforms that offer transparent pricing

How carriers are responding

Maersk, MSC, and other shipping lines are already responding to the crisis:

- Maersk: Excluded Rotterdam, redirected to Hamburg, and introduced a domestic transshipment surcharge of €10/TEU

- MSC: Diverted vessels from highly congested ports to less crowded alternatives

- CMA CGM: Focused on expanding port networks in Eastern Europe

The goal is to optimize schedules, reduce wait times, and keep transportation costs under control despite changing port conditions.

What’s next for freight forwarders?

The challenges posed by congestion in European ports in 2025 are testing the limits of global logistics. But they’re also revealing which companies are prepared and agile enough to adapt. Freight forwarders that invest in better visibility, smarter routing, and diversified port strategies will come out ahead. The lesson is clear: relying on traditional port networks no longer guarantees reliability.

In this high-pressure environment, flexibility is the key. Whether it means shipping through Trieste instead of Rotterdam, shifting from barge to rail, or syncing with carrier alliances to anticipate route changes, the best logistics players are the ones who move fast and plan smarter. Stay alert, stay informed and never assume the usual route will be the best one.